Compounding Pharmacy Fraud

What is Compounding Pharmacy Fraud and How Does it Work?

Compounding is the practice of combining pharmaceutical ingredients into a specialized form or dosage designed to accommodate the individualized needs of a specific patient. For instance, compounding could involve combining pharmaceutical compounds into a liquid or cream form because the intended patient cannot digest medication in pill form. Because compounding pharmacies personalize medication to a specific patient, it would be not be feasible for the FDA to test and approve each and every individualized compound and thus compounded pharmaceuticals are not regulated by the FDA. This alcove of de-regulation, designed to help patients who could not find any other remedy, has been exploited by unscrupulous opportunists in recent years whose singular goal is to make as much profit as possible.

“”Fraud and abuse by pharmacies and medical providers which bill for compounded pain prescriptions [are] a significant threat to the DOD health care system” -Department of Defense Special Agent John F. Khin.

Typically, a compounding pharmacy fraud scheme operates by combining rather standard pharmaceutical ingredients into a different form or package which makes that compound technically a new drug. As a “new drug” that compound gets a new National Drug Code (NDC), which is the code that the FDA and the medical industry use to categorize and price drugs and as a “new drug” the entity running the pharmacy essentially gets to set its own price for the compound. The prices set by compounding pharmacies engaged in fraud often have no relation to the cost of the component drugs and are simply as high as the fraudulent entity dares to ask for the drugs. In a recent case, a fraudulent compounding pharmacy scheme billed and received $31,000 for one tube of standardized pain cream.

The ability to charge such astronomical prices has attracted individuals only concerned with profit and such unscrupulous owners often flout other health care fraud laws to further increase profit. For instance, recently uncovered compounding pharmacy fraud schemes have utilized blatant kickbacks to induce doctors to write prescriptions and well as cold-calling telemarketers who illegally solicit patients to provide their medical information so the telemarketers can enlist them in automatic prescription re-fill programs for compounded medications, that the patient did not request or need.

TRICARE Compounding Pharmacy Fraud

A major area of compounding fraud has been targeted on the TRICARE benefit, the federal government payor for military health insurance. Until May 2015, TRICARE had more lenient reimbursement policies than other government healthcare programs. Further, TRICARE did not require the components of compounded medications to be approved by the FDA. The combination of these policies led to massive fraud and abuse.

To thank our brave military service persons and their families for the service to the country, these fraudsters developed sales practices that included harrassing cold-calls offering compounded medications and mailing unrequested and unneeded compounded medications to TRICARE beneficiaries and charging TRICARE unless the beneficiaries returned the medications.

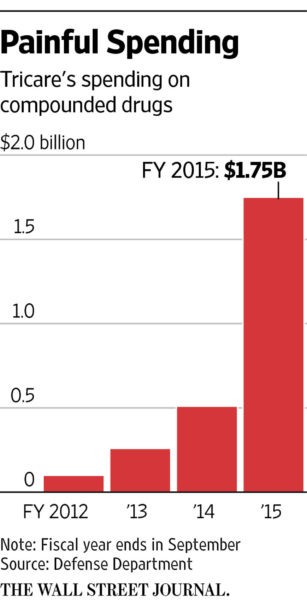

The damage done to the TRICARE budget through compounding pharmacy fraud has been astounding. TRICARE costs for compounded drugs skyrocketed from $5 million in 2004 $1.75 billion in 2015. From 2013 to mid-2015 the government estimates there was over $2 billion in fraudulent billings for compounded drugs.

Our Attorneys are National Qui Tam Experts and Trial Lawyers.

“The Accomplishments of Frohsin Barger & Walthall warrant the wealth of accolades that it has received.” — Benchmark Plaintiff”

Jim Barger and Elliott Walthall are the only private attorneys general in the country ever to be tapped as part of a Department of Justice trial team in a Medicare fraud jury trial. A noted expert on the False Claims Act, Jim Barger teaches upper level courses on the subject as an adjunct professor at the University of Alabama School of Law, which was ranked among the top 15 law schools in the nation by Business Insider in 2016. Barger has appeared on HuffPost Live, Fox 6 Atlanta, and NPR and his opinions regularly are sought by major newspaper outlets on False Claims Act Medicare enforcement, including The New York Times and The Washington Post.

Both Jim Barger and Elliott Walthall have spoken on national panels about Medicare fraud for the American Bar Association, the American Association for Justice, and Taxpayers Against Fraud. In 2015, Barger was a featured symposium speaker on Medicare Fraud and the False Claims Act at the Georgetown Law Center in Washington, DC. and in 2016, Georgetown’s American Criminal Law Review published a new research article by Barger on the public-private partnership of the False Claims Act.

“Compounding Fraud on the Rise as Sixteen Individuals Are Charged in $175 Million Fraud Scheme”

Frohsin Barger & Walthall Represents Whistleblowers Nationwide.

Frohsin Barger & Walthall investigates and litigates qui tam actions on behalf of whistleblowers in federal and state actions across the country. Our representation includes evaluating, investigating, and filing qui tam actions as well as assisting prosecutors and investigative agents in pursuing cases and reaching settlements, with a high-percentage of our cases resulting in government intervention. We have sealed cases in multiple states across the country and regularly travel to meet with United States Attorney’s offices, State Attorney General Offices, and United States Department of Justice attorneys in Washington, DC.

The False Claims Act Offers Protection and Rewards for Whistleblowers.

Blowing the whistle on corporate fraud takes courage, and the law rewards that courage with certain protections. We understand that perhaps the most important aspect of representing corporate whistleblowers is guiding and protecting them through the difficult, stressful process of litigation. The False Claims Act provides for a whistleblower’s case to be filed under seal and for the identity of the whistleblower to be protected during the course of the government’s investigation. Further, federal laws protect against retaliation by mandating the reinstatement of wrongfully fired employees at the same seniority level, and an award of double back pay, interest, and attorneys’ fees. Finally, successful whistleblowers are entitled to substantial rewards, including up to 30% of any False Claims Act recovery which Congress has mandated is three times the amount of fraud that is proven through the whistleblower’s allegations plus substantial civil penalties.