Antidumping & Countervailing Duties Fraud

What Are Antidumping and Countervailing Duties?

Antidumping and Countervailing Duties (AD/CVD) are important tools used by the United States to guard against unfairly priced and government-subsidized imports from foreign countries. Anti-competitive imports are sold at a price lower than the cost of production and are often financed by foreign governments seeking to dominate the global market.

To protect against these unfair and anticompetitive policies, America has a process that allows injured U.S.-market participants to petition the U.S. government for relief in the form of AD/CVD orders. If unfair pricing is found, then an AD/CVD order is issued and the unfairly priced imports are subject to an AD/CV duty upon importation that counter-balances the subsidies the foreign companies receive and accounts for the cost of production. The rate of the AD/CV duty, known as the dumping margin, can be upwards of 300% of the value of the imported merchandise.

Harm Due to AD/CVD Fraud:

With AD/CVD potentially exceeding 300% of the value of imported merchandise, the incentive for fraudsters and smugglers to evade AD/CVD is high. Thus, after a struggling U.S. company or industry group has gone through the extensive and costly legal process to gain fair trade protection from an AD/CVD order, they face the challenge of preventing AD/CVD evasion. Domestic companies are often still prejudiced by the same unfair pricing they sought to eradicate due to smuggling and evasion of AD/CVD. This economic injury from AD/CVD evasion is widespread and harms domestic companies, American workers, and U.S. economy as a whole.

Harm to Particular Industries:

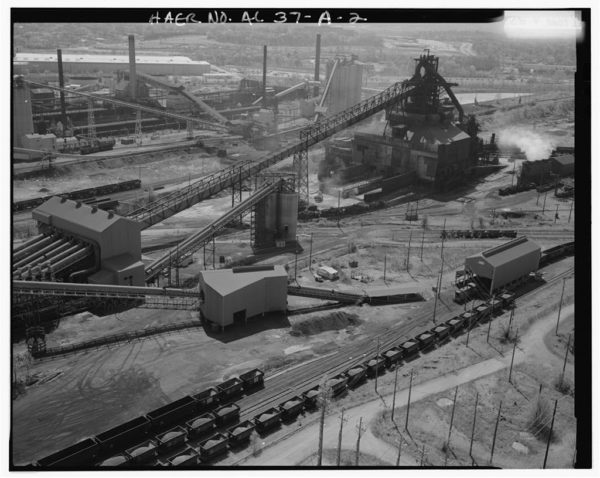

Certain domestic industries – particularly manufacturing industries – have been particularly harmed by unfair trade practices. The American steel industry has been at the forefront of the AD/CVD battle. Imports of foreign, government-subsidized steel – primarily from China – have flooded the U.S. market and created a glut in worldwide steel supply. From 2000 to 2014, Chinese steel production increased a market-rattling 540%, while U.S. steel production fell 13%. The effect of this Chinese government-sponsored steel inundation has been disproportionately felt by U.S. steel manufacturers and workers. Pictured to the left is the once-prodigious Fairfield Blast Furnace near Birmingham, Alabama. In 2015, after protracted efforts to alleviate the deluge of Chinese imports by imposing AD/CVD orders, U.S. Steel was still forced to close the Fairfield Blast Furnace, laying off over 1,000 American workers in the process. With hundreds of thousands of American jobs dependent on the domestic steel industry, the threat from unfairly subsidized imports could be disastrous for the American economy. When fraudsters evade AD/CVD orders, the protection afforded by those orders is negated and the American economy has no defense against the onslaught of unfairly priced imports.

“The [EAPA] reinforces CBP’s existing authorities and tools to collect and investigate public allegations of duty evasion, improving the overall effectiveness and enforcement of CBP law enforcement actions concerning illicit trade activity, specifically in the area of antidumping and countervailing duty evasion schemes.” – R. Gil Kerlikowske, CBP Commissioner

AD/CVD Enforcement Has Become a Major Initiative For U.S. Customs and Border Protection.

Because the economic implications of AD/CVD are so substantial and evasion so pervasive, Customs and Border Protection (CBP) has made AD/CVD enforcement a major agency priority. This has led to an increase in AD/CVD evasion False Claims Act (FCA) cases and recent enactment of the Enforce and Protect Act of 2015 (EAPA). Under the EAPA, an interested party who believes that another entity is engaging in AD/CVD evasion may submit an allegation of evasion to CBP. After receiving an EAPA allegation, CBP can decide whether to carry out an administrative investigation.

The efficient and transparent EAPA investigations are a welcome addition to the tools that can be used to enforce AD/CVD orders and prosecute AD/CVD fraud. Currently, however, the EAPA provisions – in divergence from the FCA and other administrative whistleblower laws – do not include a whistleblower’s reward or even provide for attorney’s fees incurred during a successful allegation. Therefore, the availability of a whistleblower reward is one of the strategic advantages that come from pursuing AD/CVD evasion allegations through the FCA in addition to the EAPA.

“Frohsin Barger & Walthall Wins $3 Million Antidumping Duties Fraud Settlement”

Frohsin Barger & Walthall Represents Whistleblowers Nationwide.

Frohsin Barger & Walthall investigates and litigates qui tam actions on behalf of whistleblowers in federal and state actions across the country. Our representation includes evaluating, investigating, and filing qui tam actions, as well as assisting prosecutors and investigative agents in pursuing cases and reaching settlements, with a high percentage of our cases resulting in government intervention. We have sealed cases in multiple states across the country and regularly travel to meet with United States Attorney’s offices, State Attorney General Offices, and United States Department of Justice attorneys in Washington, DC.

The False Claims Act Offers Protection and Rewards for Whistleblowers.

Blowing the whistle on corporate fraud takes courage, and the law rewards that courage with certain protections. We understand that one of the most important aspects of representing corporate whistleblowers is guiding and protecting them through the difficult, stressful process of litigation. The False Claims Act (FCA) provides for a whistleblower’s case to be filed under seal and the identity of the whistleblower to be protected during the course of the government’s investigation. Further, federal laws protect against retaliation by mandating the reinstatement of wrongfully fired employees at the same seniority level, as well as an award of double back-pay, interest, and attorneys’ fees. Finally, successful whistleblowers are entitled to up to 30% of any FCA recovery, which Congress has mandated is three times the amount of fraud that is proved through the whistleblower’s allegations plus substantial civil penalties.

A significant characteristic of customs fraud qui tam cases is that companies that are competitors of entities engaged in AD/CVD fraud often have valuable insider information regarding their competitor’s fraudulent schemes and have served as relators. Additionally, current and former employees of companies committing customs fraud have served as relators in successful import qui tam cases.

Frohsin Barger & Walthall whistleblower cases have been featured in the following media outlets, among others:

Click on the media outlet logo to read the featured story.