Frohsin Barger & Walthall (FBW) is pleased to announce that our firm has helped recover nearly $25 million for our clients and the United States in 2016. This yearly total brings FBW’s total recoveries to nearly $275 million since the firm’s inception in 2008. We thank all who helped make 2016 a great year for the False Claims Act and are optimistic that the False Claims Act will continue to be the nation’s premier fraud fighting tool for years to come. The following cases represent some of our success in 2016.

Customs Fraud Case United States ex rel. Graphite Electrode Sales, Inc. v. Ameri-Source Recovers $3 Million

In February 2016, FBW favorably settled United States ex rel. Graphite Electrode Sales, Inc. v. Ameri-Source Holdings, Inc., et al. Case No. 13-cv-0474 (W.D. Pa). In that qui tam False Claims Act case, FBW was honored to represent relator Graphite Electrode Sales (GES) and successfully recover $3 million as well as secure felony convictions against defendant Ameri-Source. The case alleged Ameri-Source, a graphite importer, fraudulently evaded antidumping duties on imports of graphite electrodes from China.

In 2009, an antidumping order (Order) was issued on small-diameter graphite electrodes, which are used as a fuel source in the steel making process. The Order, implemented to safeguard American manufacturers from unfair Chinese pricing, instituted approximately 160% duties on small diameter graphite electrodes from China. Ameri-Source – seeking to simply maximize profit – engaged in multiple schemes to evade these duties and thereby flouted the US law designed to protect domestic industries and gained a significant advantage over its competitors such as GES. Due to Ameri-Source’s fraud, GES was unable to compete simply because they followed the law and Ameri-Source did not.

The FBW litigation team investigated the case and discovered that Ameri-Source was transshipping graphite electrodes from China through shell corporations in India and also mislabeling imports subject to the duties. With this evidence and GES’s industry insider knowledge of the pricing and supply of graphite electrodes, FBW drafted and filed a qui tam complaint on behalf of the United States. The primary False Claims Act allegation in the Complaint was what is known as a “reverse false claim.” Reverse false claims are implicated when a defendant knowingly withholds money it knows belong to the United States. By avoiding paying millions of dollars in antidumping duties by fraudulently misrepresenting the country of origin and characteristics of the electrodes, Ameri-Source was clearly committing “reverse false claims.”

FBW worked with outstanding local counsel and filed the GES case right in Ameri-Source’s backyard, the Western District of Pennsylvania, Pittsburgh Division. After filing the case, the United States Attorney Office for the Western District of Pennsylvania, Department of Justice attorneys in Washington D.C. and Customs and Border Protection agents zealously investigated the case. The fruits of this labor was realized in February of 2016 when the civil settlement of $3 million was finalized and Ameri-Source pled guilty to two felony counts of smuggling goods into the United States. Our client GES received $480,000 as their relator share for alerting the government to this fraud and recovered a significant amount of attorneys’ fees through subsequent litigation.

Hospice Fraud Case United States ex rel. Sharlene Rice v. Evercare Helps Recover $18 Million

Frohsin Barger & Walthall also helped return $18 million to the taxpayers in qui tam False Claims Act case United States ex rel. Sharlene Rice v. Evercare Case No. 1:14-cv-01647 (D. Colo). In that case, FBW represented Sharlene Rice, a brave hospice nurse who came forward to expose a widespread scheme of hospice fraud powered by corporate greed and disregard of taxpayer funds. Ms. Rice alleged that Evercare, a nation-wide hospice corporation, systematically and intentionally admitted ineligible patients to hospice care in order to maximize its bills to the Medicare program.

The Medicare hospice benefit covers hospice services for the most vulnerable of us, those who are terminally ill and determined to be within the last six months or less of life. Evercare, a for-profit hospice company, often admitted patients to hospice service who were not, by medical evidence, within six months of death. These admissions of non-terminally ill patients were in clear violation of Medicare regulations and by submitting claims for payment for ineligible patients, Evercare allegedly violated the False Claims Act. Evercare’s opportunistic fraud not only drained the Medicare budget for beneficiaries that actually need hospice care but also deprived the victimized patients of the appropriate, healing care they needed.

In July 2016, Ms. Rice’s consolidated case was settled for $18 million and a significant percentage of that money was returned to the taxpayers to help fund health care for patients in need.

Confidential Settlements

Frohsin Barger & Walthall also achieved multiple confidential settlements in 2016. One confidential settlement recovered approximately $2.3 million for the United States and our client, the relator in a qui tam False Claims Act case against a national health care provider. Frohsin Barger & Walthall also recovered roughly $500,000 for our client in a whistleblower retaliation case against a major financial institution.

Frohsin Barger & Walthall thanks all who continue to fight against fraud including our colleagues at the Department of Justice, our co-counsel and affiliated attorneys, and most of all the brave whistleblowers who risk so much to expose fraud against our nation’s taxpayers. The attorneys of Frohsin Barger & Walthall are honored to be a part of 2016 serving as yet another example of why the private-public partnership of the False Claims Act is the nation’s premier fraud fighting tool.

Talk with an Expert

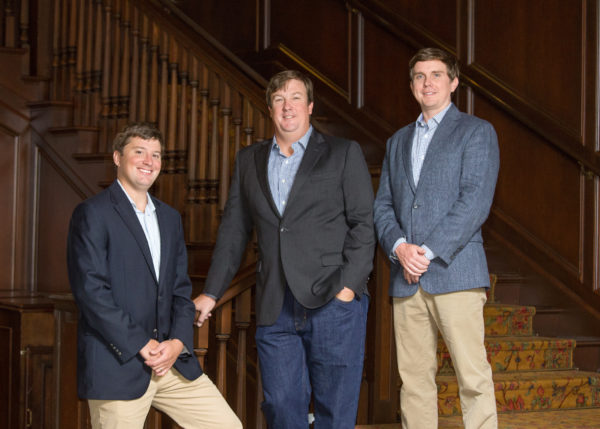

Frohsin Barger & Walthall

Call 205.933.4006 or

Send us a Message